The energy specialists concern very much about the progress of LNG import infrastructure in Southern Vietnam

09:31 | 24/11/2020

1 / Nhon Trach 3 and 4 CCGTs (1,760 MW) in Dong Nai invested by the Vietnam Oil and Gas Group (PVN), for that at present, there has signed a power purchase agreement (PPA), expect to be put into operation in 2023 - 2024.

2 / Son My 1 and 2 CCGTs have been included in Power Plan VII (adjusted).

Son My 1 BOT project (3x750 MW), invested by GDF SUEZ – SOJIT and PACIFIC Consortium with an expectation that unit 1 will be put into operation in 2026. But now GDF has withdrew from the project and instead of it is French EDF Company. It is expected that this project will be put into operation in 2027 - 2028, but in fact, the progress of the project is still unclear.

Son My 2 project (3x750 MW), assigned to the Vietnam Oil and Gas Group (PVN) and expected to be operated in 2023 - 2025, but in 2019, PVN has returned and the Government assigned AES Group to replace. The project expected to be put into operation in 2027 - 2028, but this progress also still unclear.

3 / In Ba Ria - Vung Tau province, at present, there are 5 new projects, with a total capacity of 17,350 MW, supported by the province and proposed to the Ministry of Industry and Trade to submit to the Government to add to Power Planning VII (adjusted), including:

- The Cai Mep Ha LNG – Power Complex project with a total capacity of about 6,000 MW (in Cai Mep Ha area, Phu My town), proposed for investment by Gen X Energy Company of Blackstone Investment Fund - USA and T&T Group Joint Stock Company.

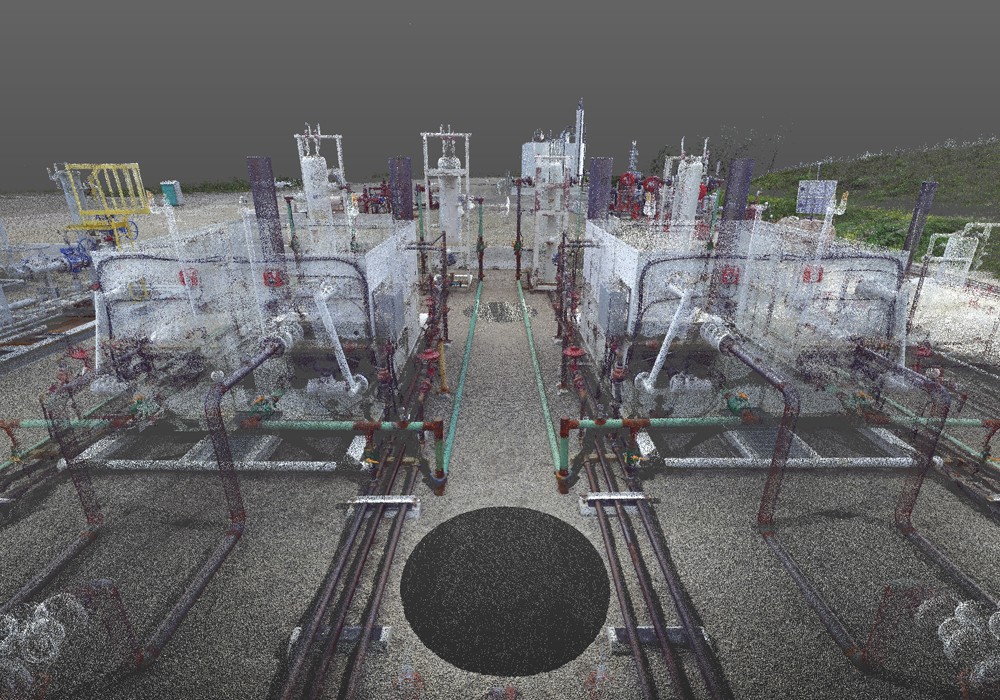

-Long Son Power Center project with a total capacity of about 4,500 MW (in Long Son commune, Vung Tau city), invested by Power Generation Corporation 3 (Genco3). The project includes a major LNG port, a LNG storage with a capacity of 3.5 million tons / year in phase 1 and increased to 6.5 million tons /year in phase 2, and an Investment value of USD 3.78 billion in phase 1, and additional USD 646.5 million in phase 2.

-Long Son LNG – Power Project (in Long Son Petroleum Industrial Park, Vung Tau City) with a total capacity of about 4,800 MW, and an investment of about USD 2.7 billion invested by Japanese Marubeni Group.

-LNG Ba Ria 2 Project (in Long Huong ward, Baria City) with a capacity of about 1,200 MW and investment capital of about USD 1.3 billion, invested by Ba Ria Thermal Power Joint Stock Company.

-Phu My 3.1 Thermal Power Project (in Phu My 1 Industrial Park, Phu My Town) with a capacity of about 850 MW, investment capital of USD 855. 7 million, proposed for investment by Phu My 3 BOT Power Ltd.

According to the specialist of Vietnam Energy Magazine, at present, from above mention projects, only Long Son 1LNG CCGT project with a capacity of 1,200 MW, invested by Genco 3 having been additionally approved to PDP, expected to be in operation by 2026 has a clear progress. The remaining all projects are classified as "potential projects".

4 / In Ninh Thuan province, there is Ca Na Power Center with a total capacity of 6,000 MW (4 x 1,500 MW). At present, the Government has supplemented to PDP Ca Na 1 LNG CCGT project with a capacity of 1,500 MW, expected to be operated by 2026.

5 / In Bac Lieu province, the Government has agreed to supplement Bac Lieu LNG CCGT project with a capacity of 3,200 MW, that expects to be in operation by 2025 – 2026 with a electricity price of 7 UScents/kWh

The total capacity of CCGT projects fired by domestic natural gas and import LNG in Central and Southern Vietnam, which should be operated until 2030 is 19,500 MW including O Mon 2-3-4, Dung Quat 1-2-3, Chu Lai 1-2, Nhon Trach 3-4, Son My 1-2, Quang Tri, Bac Lieu, Long Son 1 and Ca Na 1.

However, the feasibility of progress of many of the above projects depend on gas pipeline projects and import LNG terminal infrastructure (port, storage) projects, which will face a lot of “"risky". In concrete: the O Mon cluster (3,150 MW) still has problems with the procedures for approving the gas –power chain; The Blue Whale Cluster (3,750 MW) has been delayed for 2 years from the original plan, while the Son My cluster (4,500 MW) is currently only in the initial negotiation stage.

In particular, CCGTs fired by LN projects with a total capacity of 6,000 MW having just been added to the power development planning face concerns about the LNG supply chain and terminal infrastructure.

VER.